To register and login on the GST Portal in India, visit the official website and follow the step-by-step instructions. The process is straightforward and user-friendly.

The Goods and Services Tax (GST) Portal is the official platform for managing GST-related activities in India. It allows businesses to register, file returns, pay taxes, and track compliance. Registering on the GST Portal is essential for businesses to meet regulatory requirements and benefit from various GST provisions.

This guide will walk you through the registration and login process, ensuring a smooth experience. By following these steps, you can efficiently handle your GST obligations and maintain compliance with Indian tax laws. The portal simplifies complex tax processes, making it easier for businesses to operate.

Introduction To Gst Portal

The GST Portal is an online platform that helps Indian taxpayers manage their GST (Goods and Services Tax). It simplifies the process of GST registration, filing returns, payments, and more. The portal is essential for businesses to comply with GST regulations.

Purpose And Importance

The GST Portal serves several critical purposes:

- Registration: New taxpayers can register for GST online.

- Return Filing: Businesses can file their GST returns through the portal.

- Payments: The portal allows for easy GST payments.

- Tracking: Users can track their return status and payments.

The portal is vital for ensuring compliance with GST laws. It helps streamline the process, saving time and reducing errors. Businesses can avoid penalties by using the portal to meet their GST obligations.

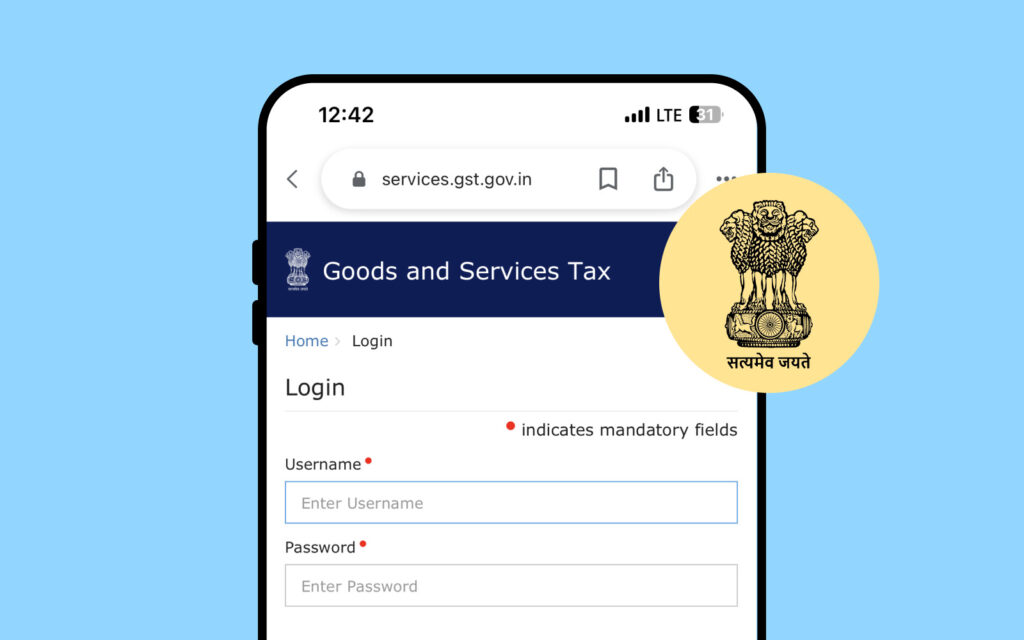

Accessing The Gst Portal

Accessing the GST Portal is straightforward:

- Visit the Official Website: Go to www.gst.gov.in.

- Click on ‘Login’: You’ll find the login option at the top right corner.

- Enter Credentials: Provide your username and password.

- Captcha Code: Enter the captcha code displayed on the screen.

- Click ‘LOGIN’: Finally, click the login button to access your account.

New users must register first. The registration process involves:

- Filling out the application form.

- Uploading required documents.

- Verification and approval.

Once registered, users can log in anytime to manage their GST-related tasks.

Getting Started With Gst Registration

Registering for GST is a crucial step for businesses in India. This guide will simplify the process for you. You’ll learn about eligibility, required documents, and the steps to register online.

Eligibility Criteria For Gst

Before starting, ensure your business is eligible for GST registration. Here are the main criteria:

- Businesses with an annual turnover of over ₹20 lakhs.

- Service providers with an annual turnover of over ₹20 lakhs.

- Special category states with an annual turnover of over ₹10 lakhs.

- Interstate suppliers of goods and services.

- E-commerce operators and aggregators.

- Casual taxable persons and non-resident taxable persons.

Documents Required For Registration

Gather the following documents before you begin the GST registration process:

| Type of Document | Description |

|---|---|

| PAN Card | Permanent Account Number of the business or the owner. |

| Identity Proof | Passport, Voter ID, Aadhar Card, or Driving License. |

| Address Proof | Electricity bill, Rent agreement, or Property tax receipt. |

| Bank Account Proof | Cancelled cheque or bank statement. |

| Business Registration Proof | Partnership deed, Incorporation certificate, or any other document. |

| Photograph | Passport-sized photographs of the owner or partners. |

| Authorization Letter | Required if an authorized signatory is registering on behalf of the business. |

Ensure all documents are scanned and ready in the required formats. This will make the online registration process smooth.

Step-by-step Registration Process

Registering on the GST portal is essential for businesses in India. This guide will walk you through the step-by-step process. Follow these simple steps to register and login online.

Creating An Account

To start, visit the official GST portal. Click on the “Register Now” button.

Choose “New Registration”. Enter your details such as Legal Name of the Business, PAN, Email, and Mobile Number.

You will receive an OTP on your email and phone. Enter the OTPs to verify your details.

Next, create a username and password. Make sure to remember these for future logins.

Filling The Application Form

After creating an account, log in to the GST portal. Click on the “Services” tab and choose “Registration” and then “New Registration”.

The application form will appear. Fill in details like Business Information, Promoters/Partners Information, and Authorized Signatory.

Provide your Principal Place of Business details. Enter the Additional Places of Business if any.

Upload a Photograph of the authorized signatory. Fill in the details of your Bank Account.

Document Submission

Prepare the required documents before submission. These include Proof of Business Address, PAN, and Aadhar Card.

Upload these documents in the required formats. Make sure each document is clear and legible.

Double-check all the details. Ensure there are no mistakes in the form or documents.

Verification And Acknowledgement

After submitting the form, the GST portal will verify your details. This may take a few days.

You will receive an Acknowledgement Reference Number (ARN) on your registered email and phone. Keep this number safe.

Once verified, you will receive your GSTIN. You can use this number to login and access the GST portal services.

Congratulations! You are now registered on the GST portal. You can now file returns, pay taxes, and manage your GST compliance online.

Navigating The Gst Dashboard

Welcome to the simplified guide on navigating the GST dashboard. The GST portal is essential for all businesses in India. This guide will help you understand how to use the dashboard effectively. Let’s dive into the features and account management.

Dashboard Features

The GST dashboard is your central hub for managing GST-related activities. It provides various features to help you stay compliant.

- Overview: Get a quick summary of your GST activities. This includes recent filings, pending tasks, and alerts.

- Return Filing: Access options to file your GST returns. You can view past submissions and upcoming deadlines.

- Payment Status: Check your tax payment status. You can see pending payments, paid invoices, and refunds.

- Notices: View all GST-related notices and communications. Respond promptly to avoid penalties.

Managing Your Account

Managing your account on the GST portal is crucial for seamless operations. Here are some key aspects:

- Profile Update: Keep your business details updated. This includes your address, email, and phone number.

- User Roles: Assign roles to your team members. Ensure each member has the right access level.

- Security Settings: Enhance your account security. Enable two-factor authentication for added protection.

By understanding these features and managing your account effectively, you can navigate the GST dashboard with ease. Stay compliant and manage your GST activities efficiently.

Login Procedures

Logging into the GST portal is a crucial step for businesses in India. It allows access to services such as filing returns, paying taxes, and tracking compliance. This guide simplifies the login procedures, ensuring a smooth experience.

Primary Login Steps

Follow these steps to log in to the GST portal:

- Visit the GST Portal: Open your web browser and go to GST Portal.

- Click on Login: Locate the ‘Login’ button on the top right corner of the homepage.

- Enter Credentials: Input your Username and Password in the respective fields.

- Solve CAPTCHA: Enter the characters shown in the CAPTCHA image for verification.

- Click on Login: Press the ‘Login’ button to access your account.

Troubleshooting Common Login Issues

If you face issues logging in, try these solutions:

| Issue | Solution |

|---|---|

| Forgot Username | Click on ‘Forgot Username’ and follow the prompts to retrieve it. |

| Forgot Password | Click on ‘Forgot Password’, enter your Username, and follow the steps to reset it. |

| CAPTCHA Error | Refresh the page to get a new CAPTCHA and try again. |

| Account Locked | Contact GST helpdesk for unlocking your account. |

| Technical Glitches | Clear browser cache and cookies, then attempt to log in again. |

By following these steps and solutions, you can ensure a hassle-free login to the GST portal. This helps in efficient tax management and compliance.

Handling Gst Returns And Payments

Managing GST returns and payments is crucial for every business in India. This guide simplifies the process, ensuring compliance and avoiding penalties.

Filing Returns Online

The GST portal makes it easy to file returns online. Follow these steps:

- Log in to the GST portal using your credentials.

- Navigate to the Returns Dashboard.

- Select the return period and form type.

- Fill in the required details and verify the information.

- Submit the return and download the acknowledgment.

Making Tax Payments

Paying your GST dues online is simple and secure. Here’s how:

- Log in to the GST portal.

- Go to the Payments section.

- Select Create Challan and enter the tax amount.

- Choose your preferred payment method (e.g., net banking, credit card).

- Complete the payment and save the receipt.

Tracking Payment Status

After making a payment, it’s essential to track its status. Follow these steps:

- Log in to the GST portal.

- Click on the Payment History tab.

- Enter the relevant details like CPIN or Challan ID.

- View the status of your payment.

- If successful, download the payment confirmation.

Gst Portal Services

The GST Portal in India offers a wide range of services. These services help businesses comply with GST regulations. This section will guide you through the available services and how to request assistance.

Available Services

The GST Portal provides various services for taxpayers. Here are some of the key services:

- Registration: You can register for GST online. This is the first step for any business under GST.

- Returns Filing: File your GST returns quickly and accurately.

- Payments: Pay your GST dues online through the portal.

- Refunds: Apply for GST refunds if you have paid more than required.

- Ledgers: View and manage your electronic cash and credit ledgers.

- Notices: Respond to notices and orders issued by the tax authorities.

| Service | Description |

|---|---|

| Registration | Register for GST online. |

| Returns Filing | File your GST returns quickly. |

| Payments | Pay your GST dues online. |

| Refunds | Apply for GST refunds. |

| Ledgers | View and manage your ledgers. |

| Notices | Respond to tax notices. |

Requesting Assistance

If you need help, the GST Portal offers various support options:

- Help Desk: You can contact the help desk for immediate assistance.

- FAQs: The portal has a comprehensive FAQ section.

- User Manual: Detailed user manuals are available for all services.

- Video Tutorials: Watch video tutorials for step-by-step guidance.

For any issues, you can also raise a ticket through the portal. The support team will address your concerns promptly.

Maintaining Compliance

Maintaining compliance with GST regulations is crucial for every business in India. This ensures smooth operations and avoids penalties. Learn how to stay compliant with regular updates and a comprehensive compliance checklist.

Regular Updates

Staying updated with GST laws is essential. The GST portal frequently releases updates and notifications. Regularly checking for these updates helps your business stay compliant.

Subscribe to official newsletters and alerts. This way, you won’t miss any important changes. Ensure your accounting software is up-to-date with the latest GST rules.

Compliance Checklist

Follow this checklist to maintain compliance:

- Register your business on the GST portal.

- File GST returns on time.

- Maintain accurate invoices and records.

- Ensure proper input tax credit claims.

- Regularly reconcile your accounts.

Use the table below to track your GST compliance tasks:

| Task | Frequency |

|---|---|

| GST Return Filing | Monthly/Quarterly |

| Invoice Maintenance | Ongoing |

| Input Tax Credit Reconciliation | Monthly |

| Record Keeping | Ongoing |

Ensure each task is completed on time. This helps avoid penalties and interest charges.

Advanced Portal Features

The GST portal in India is not just about registration and filing returns. It offers several advanced features that make compliance easier. These features streamline processes, provide crucial information, and simplify tax management. Let’s explore some key advanced features.

E-way Bill Generation

E-Way Bill Generation is a critical feature of the GST portal. It ensures the smooth movement of goods. The process is simple and efficient.

- Log in to the GST portal.

- Navigate to the E-Way Bill section.

- Click on Generate New.

- Fill in the required details like Invoice Number and Transporter ID.

- Click Submit to generate the E-Way Bill.

Benefits of E-Way Bill Generation:

| Benefit | Description |

|---|---|

| Transparency | Tracks goods movement, ensuring transparency. |

| Compliance | Ensures compliance with GST laws. |

| Efficiency | Reduces paperwork, speeding up processes. |

Input Tax Credit

Input Tax Credit (ITC) is another essential feature of the GST portal. It allows businesses to claim credit for the tax paid on purchases. This reduces the tax liability.

- Log in to the GST portal.

- Go to the Returns section.

- Select the relevant return form (e.g., GSTR-3B).

- Fill in the details of purchases and input tax.

- Submit the return to claim ITC.

Advantages of Input Tax Credit:

- Reduces Tax Liability: ITC reduces the overall tax burden on businesses.

- Promotes Transparency: Ensures that all transactions are recorded.

- Encourages Compliance: Businesses are incentivized to maintain proper records.

These advanced features of the GST portal enhance the efficiency and transparency of tax processes. They help businesses stay compliant and manage their taxes better.

Security And Privacy On Gst Portal

The GST Portal is crucial for taxpayers in India. It handles sensitive financial data. Ensuring security and privacy on the GST Portal is essential. This guide will help you understand how to protect your information and follow best practices.

Protecting Your Information

Protecting your information on the GST Portal is vital. The portal uses advanced encryption technologies to safeguard your data. Always ensure you are on the official GST website: www.gst.gov.in.

| Security Feature | Description |

|---|---|

| SSL Encryption | Secures data transmitted between your browser and the GST server. |

| Two-Factor Authentication | Adds an extra layer of security by requiring a second form of verification. |

Best Practices

- Use Strong Passwords: Create passwords with a mix of letters, numbers, and symbols.

- Update Regularly: Change your password every three months.

- Enable Two-Factor Authentication: Use this for an additional security layer.

- Avoid Public Wi-Fi: Do not access the GST Portal on public networks.

- Log Out: Always log out after completing your session.

Following these best practices ensures your data remains safe. The GST Portal’s security measures and your vigilance work together to protect your information.

Troubleshooting And Support

Registering and logging in to the GST Portal can be confusing. You may face technical issues. This section will guide you through common glitches and how to get help.

Common Technical Glitches

Sometimes, you might face issues while using the GST Portal. Here are some common problems:

- Login Issues: Incorrect password or username.

- Slow Loading: High traffic on the portal.

- Page Not Found: Broken links or server issues.

- Captcha Problems: Unable to read or submit captcha.

Most of these issues are easy to fix. Check your internet connection first. Make sure you are entering the correct details. Clear your browser cache and cookies. This can solve many problems.

Contacting Helpdesk

If you still face issues, you can contact the GST helpdesk. They are available to assist you.

| Method | Details |

|---|---|

| Phone | 1800-1200-232 |

| [email protected] | |

| Live Chat | Available on the GST Portal |

When contacting the helpdesk, have your details ready. This includes your GSTIN and any error messages you received. They will help you resolve the issue quickly.

Updating Business Details

Keeping your business details up-to-date on the GST portal is crucial. It ensures smooth transactions and compliance. This guide simplifies the process of updating your business details. Follow these steps to make changes without any hassle.

Edit Profile Information

To edit your profile information, log in to the GST portal. Go to the dashboard and click on the ‘Services’ tab. Under the ‘Registration’ menu, select ‘Amendment of Registration Non-Core Fields’.

You will see various sections where you can update your information. Make the necessary changes in the ‘Business Details’ section. Ensure all the details are accurate before submitting.

| Field | Information to Update |

|---|---|

| Legal Name | Update the registered legal name of your business. |

| Trade Name | Update the trade name if it differs from the legal name. |

| Address | Update the principal place of business address. |

After updating the information, click on ‘Save’. Review the changes and click ‘Submit’ to finalize.

Changing Bank Details

To change your bank details, navigate to the ‘Services’ tab on the GST portal. Under the ‘Registration’ menu, select ‘Amendment of Registration Non-Core Fields’.

In the amendment form, go to the ‘Bank Accounts’ tab. Here, you can add or edit bank account information.

- Click on ‘Add New’ to enter a new bank account.

- Fill in the required details like bank name, account number, and IFSC code.

- Upload a scanned copy of a bank statement or a cancelled cheque.

To edit existing bank details, click on the ‘Edit’ icon next to the account. Make the necessary changes and save.

Ensure all the information is correct before submitting. Click ‘Save’ and then ‘Submit’ to complete the process.

Portal Downtime And Maintenance

Registering and logging into the GST portal is crucial for businesses in India. But the portal sometimes experiences downtime due to maintenance. Understanding these downtimes helps users plan their activities better.

Scheduled Maintenance

The GST portal undergoes scheduled maintenance to ensure smooth functionality. This maintenance usually happens during off-peak hours. The portal team announces these schedules in advance. Users can find this information on the GST portal homepage.

During scheduled maintenance, the portal may be temporarily unavailable. Users should plan their tasks around these times. This helps avoid disruptions in their work.

| Maintenance Type | Time | Duration |

|---|---|---|

| Weekly Update | Sunday, 2:00 AM – 4:00 AM | 2 Hours |

| Monthly Upgrade | First Saturday, 12:00 AM – 6:00 AM | 6 Hours |

Emergency Downtime Notifications

Sometimes, the GST portal faces unexpected issues. These issues require immediate attention. The team may declare an emergency downtime to fix problems quickly.

During emergency downtimes, users may experience sudden access issues. The GST portal team sends notifications to registered users. These notifications contain details about the issue and expected resolution time.

To stay updated, users should check their emails and the portal’s notification section regularly. This ensures they are aware of any sudden downtimes and can adjust their work accordingly.

- Check email notifications

- Visit the GST portal notification section

- Plan tasks around announced downtimes

Frequently Asked Questions

How Can I Register For Gst Online In India?

Visit the GST portal at gst. gov. in. Click on “Register Now” under the Taxpayers section. Fill out the Part A form with your details. Receive a Temporary Reference Number (TRN). Complete Part B using the TRN. Submit required documents and verification.

How To Access Gst Portal From Outside India?

To access the GST portal from outside India, visit www. gst. gov. in. Use your login credentials. Ensure a stable internet connection.

How To Get User Id And Password Of Gst?

To get your GST user ID and password, visit the GST portal. Click on “First Time Login” and follow instructions.

How Do I Fill Out A Gst Portal?

Log in to the GST portal. Navigate to the ‘Services’ tab. Select ‘Returns’ and then ‘File Returns’. Enter required details and upload documents. Submit and verify with OTP or DSC.

Conclusion

Registering and logging into the GST portal in India is now simple with this guide. Follow the steps outlined to ensure a smooth process. Stay compliant and manage your taxes efficiently. Bookmark this page for future reference. Happy filing!

Leave a Reply